The Share

DELTICOM AG

Klicken Sie auf den unteren Button, um den Inhalt von bfrank.ariva.de zu laden.

Basis data and key figures

| Stock exchanges: | Xetra, Frankfurt, Berlin, München, Düsseldorf, Hamburg, Hannover, Stuttgart, L&S RT, Tradegate, Quotrix |

| Frankfurt stock exchange segment: | Prime Standard |

| Market: | Regulated Market |

| First Trading Day: | October 26, 2006 |

| WKN (German Securities Code): | 514680 |

| ISIN: | DE0005146807 |

| LEI (Legal Entity Identification Code): | 529900F3EU2GVHVCLR26 |

| Stock Market Symbol: | DEX |

| Bloomberg: | DEX:GR |

| Reuters: | DEXGn.DE |

| Type of Shares: | No par value registered ordinary shares |

| Share Capital: | € 14,831,361 |

| Number of shares: | 14,831,361 |

| Designated Sponsor: | Stifel Europe Bank AG |

| Paying Agent: | ODDO BHF Corporates & Markets AG |

Investment Highlights

- Delticom is European online market leader in the replacement tyre trade

- Private and commercial end customers are offered a wide range of products to choose from, with more than 600 brands and over 40,000 types of tyres

- With a delivery of the tyres to a partner garage located near the buyer, Delticom increases the convenience for the customer enormously

- Our 34,000 partner garages in Europe offer customers a comprehensive range of services, from tyre fitting to general inspections/services

- Since its founding in 1999, more than 17.4 million customers have shopped in one of the company's more than 280 online shops in around 40 countries.

- Delticom has more than 20 years of expertise in setting up and operating online shops, in Internet customer acquisition, in Internet marketing and in logistics

- Several warehouse locations in Europe shorten transport routes and ensure a high delivery capacity even at seasonal peaks

- Annual revenues potential of EUR 500+ million in core business, the online tyre retailing in Europe

- Successful turnaround process initiated in mid-2019: Clear refocus on core business

- The discontinuation of non-core activities has taken place at the beginning of 2020

- The focus of the restructuring is on a sustainable improvement in profitability

- Significant improvement in operating profit already achieved through margin optimization, efficiency gains and cost reductions

- 2021: Revenues of EUR 585.4 million, EBITDA of EUR 17.1 million and EBITDA margin of 2.9 % achieved

- Guidance 2022: Revenues between EUR 480 million and EUR 520 million, accompanied by an operating EBITDA between EUR 12 million and EUR 15 million

- Operating EBIT margin of 3 % targeted in the medium term

- Delticom is positioned in a growth sector: Fundamentally strong growth of the European B2C e-commerce market volume by approx. 13 % from EUR 636 billion in 2019 to EUR 717 billion in 2020, supported by the impact of Corona

- A comparatively low penetration rate of around 13 % in the European replacement tyre trade offers further growth opportunities for the future

- Increased digitization trend and growing willingness to buy online accelerates online market penetration in the replacement tyre trade as well

Research on our share

| Date | Analyst | Recommendation | Price target | |

|---|---|---|---|---|

| 04/03/2023 | Daniel Kukalj, Quirin Privatbank | Buy | € 2.89 | Download PDF File  |

| 11/16/2022 | Daniel Kukalj, Quirin Privatbank | Buy | € 3.50 | Download PDF File  |

| 08/16/2022 | Daniel Kukalj, Quirin Privatbank | Buy | € 6.90 | Download PDF File  |

| 05/17/2022 | Jürgen Pieper, Bankhaus Metzler | Hold | € 3.30 | Download PDF File  |

| 05/16/2022 | Daniel Kukalj, Quirin Privatbank | Buy | € 8.50 | Download PDF File  |

| 03/28/2022 | Daniel Kukalj, Quirin Privatbank | Buy | € 8.50 | Download PDF File  |

| 03/28/2022 | Jürgen Pieper, Bankhaus Metzler | Buy | € 8.00 | Download PDF File  |

| 01/17/2022 | Jürgen Pieper, Bankhaus Metzler | Buy | € 15.00 | Download PDF File  |

| 11/09/2021 | Daniel Kukalj, Quirin Privatbank | Buy | € 16.00 | Download PDF File  |

| 10/08/2021 | Jürgen Pieper, Bankhaus Metzler | Buy | € 16.00 | Download PDF File  |

| 08/19/2021 | Jürgen Pieper, Bankhaus Metzler | Buy | € 16.00 | Download PDF File  |

| 08/12/2021 | Daniel Kukalj, Quirin Privatbank | Buy | € 16.00 | Download PDF File  |

| 06/28/2021 | Jürgen Pieper, Bankhaus Metzler | Buy | € 15.00 | Download PDF File  |

| 05/14/2021 | Daniel Kukalj, Quirin Privatbank | Buy | € 16.00 | Download PDF File  |

| 05/03/2021 | Jürgen Pieper, Bankhaus Metzler | Buy | € 15.00 | Download PDF File  |

| 03/29/2021 | Daniel Kukalj, Quirin Privatbank | Buy | € 16.00 | Download PDF File  |

| 03/29/2021 | Jürgen Pieper, Bankhaus Metzler | Buy | € 15.00 | Download PDF File  |

| 03/03/2021 | Jürgen Pieper, Bankhaus Metzler | Buy | € 15.00 | Download PDF File  |

| 12/15/2020 | Daniel Kukalj, Quirin Privatbank | Buy | € 7.70 | Download PDF File  |

| 11/23/2020 | Daniel Kukalj, Quirin Privatbank | Buy | € 6.50 | Download PDF File  |

Financial key figures

| 2022 | 2021 | 2020 | 2019 | 2018 | ||

|---|---|---|---|---|---|---|

| Revenues | €m | 509.3 | 585.4 | 541.3 | 625.8 | 645.7 |

| Total income | €m | 542.9 | 614.0 | 574.2 | 663.4 | 683.8 |

| Gross margin | % | 21.6 | 21.9 | 22.7 | 21.6 | 21.8 |

| Gross profit | €m | 143.7 | 156.6 | 155.9 | 172.7 | 178.7 |

| EBITDA | €m | 15.0 | 17.1 | 15.0 | -6.6 | 9.0 |

| EBITDA margin | % | 2.9 | 2.9 | 2.8 | -1.1 | 1.4 |

| EBIT | €m | 4.2 | 7.1 | 5.4 | -42.1 | 1.1 |

| Net income | €m | 2.8 | 6.8 | 6.9 | -40.8 | -1.7 |

| Earnings per share | € | 0.19 | 0.49 | 0.55 | -3.27 | 0.13 |

| Total assets | €m | 195.2 | 217.5 | 199.8 | 188.2 | 232.5 |

| Inventories | €m | 43.3 | 46.6 | 36.9 | 62.9 | 99.6 |

| Investments | €m | 2.6 | 1.2 | 1.6 | 6.6 | 10.7 |

| Equity | €m | 39.7 | 38.0 | 14.8 | 8.3 | 49.3 |

| Equity ratio | €m | 20.3 | 17.5 | 7.4 | 4.4 | 21.2 |

| Return on Equity | €m | 7.1 | 17.9 | 46.4 | -429.9 | -3.4 |

| Liquidity | €m | 3.0 | 4.9 | 5.6 | 5.3 | 3.4 |

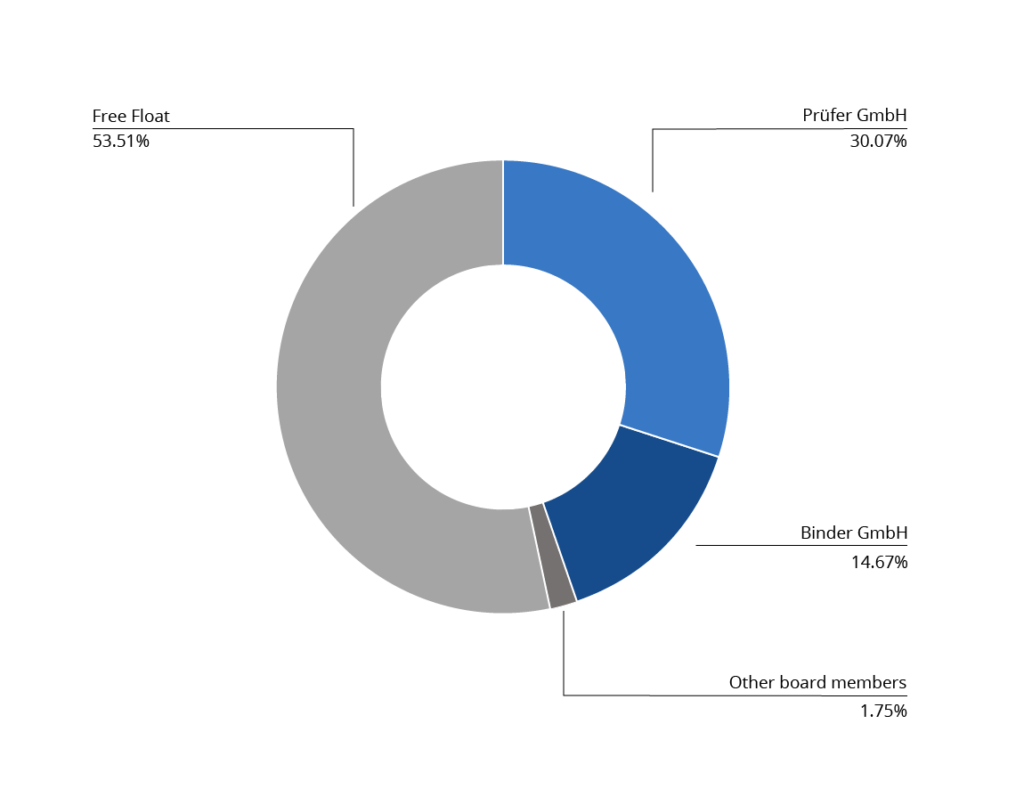

Shareholder structure